What is traded in Forex?

The simple answer is CURRENCIES. Specifically, foreign currencies.

Since currency trading involves the buying and selling of currencies without having a physical asset, we can use a simple (though not perfect) analogy to help understand it.

Imagine that buying a currency is like acquiring a stock in a company in a particular country.

The value of the currency often reflects the market’s perception of the current and future health of that country’s economy.

In the world of currency trading, when you buy, for example, British Pound, it’s as if you’re acquiring a stake in the UK economy.

You are investing in the belief that the UK economy is performing well and will improve over time.

When you eventually sell those “stocks” in the market, you hope to make a profit.

In general terms, the exchange rate of a currency compared to others reflects the economic condition of that country in relation to other economies.

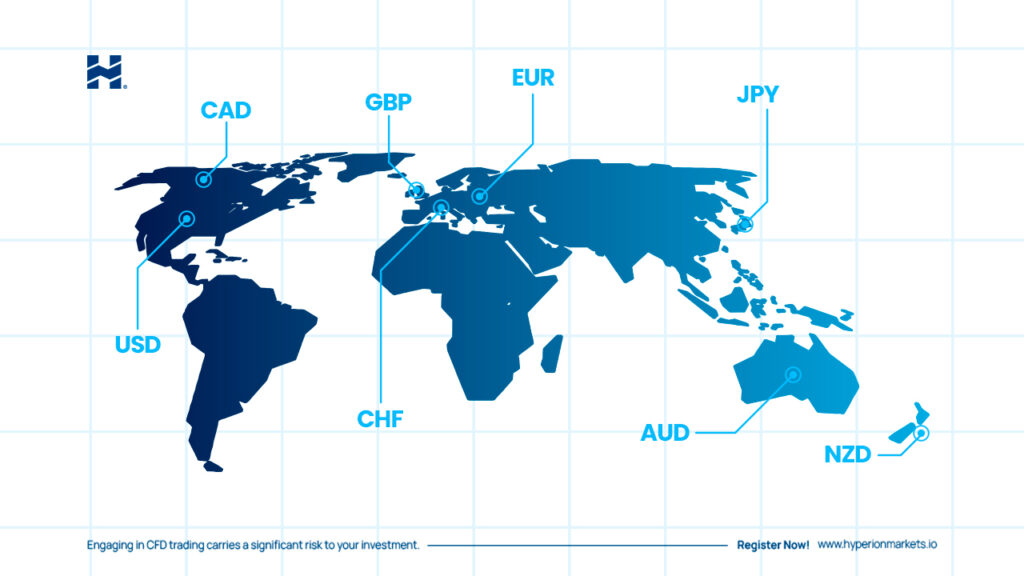

- Major Currencies

While there are many currencies you can trade, as a new trader, you’re likely to start trading with “major currencies.”

They are called “major currencies” because they are the most traded currencies and represent some of the largest economies worldwide.

Forex traders may have different opinions on what is considered “major currencies.”

Those who tend to follow a more traditional perspective only consider USD, EUR, JPY, GBP, and CHF as major currencies.

Then, they classify AUD, NZD, and CAD as “commodity currencies.”

Currency symbols always have three letters, where the first two letters identify the country’s name, and the third letter identifies the name of that country’s currency, usually the first letter of the currency’s name.

These three letters are known as ISO 4217 Currency Codes. By 1973, the International Organization for Standardization (ISO) established three-letter codes for the currencies we use today.

Using GBP as an example:

“GB” stands for Great Britain, while “P” stands for Pound.