Trading Sessions in Forex

- The Forex Market and Its Hourly Availability

The foreign exchange market (forex) operates 24 hours a day, allowing investors worldwide to participate at their convenience. However, this constant availability doesn’t imply that the market is always active.

- Importance of Market Mobility

The text underscores the difficulty of making profits when the market isn’t moving, making volatility a crucial factor for traders.

- Trading Sessions

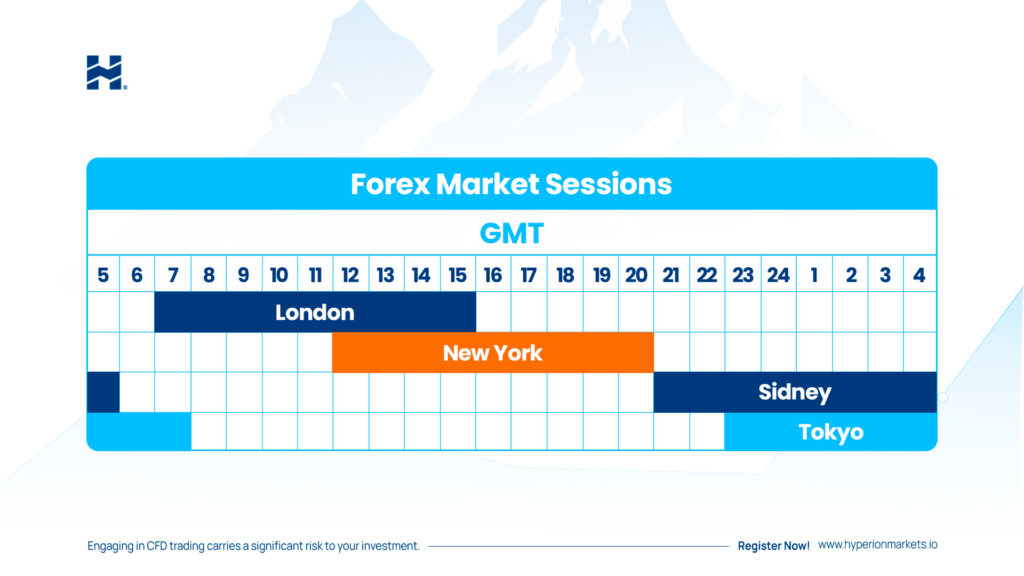

The forex market is divided into four major trading sessions: the Sydney Session, the Tokyo Session, the London Session, and the New York Session. Each of these sessions has its own characteristics and optimal times for trading.

- Forex 3-Sessions System

Investors often focus on one of the three most active sessions: the Asian (Tokyo), the European (London), and the North American (New York). This strategy is known as the “Forex 3-Sessions System.”

- Opening and Closing Hours

The opening and closing hours of each session are based on local time. Most sessions start between 7 and 9 in the morning, local time.

- Changes Due to Daylight Saving Time

Opening and closing hours may vary during October/November and March/April, as some countries like the United States, the United Kingdom, and Australia switch to/from Daylight Saving Time (DST). This can complicate trading schedules.

- Trading Session Overlaps

There are overlapping periods between trading sessions, during which two sessions are open simultaneously. These times are typically the most active in the market, involving participants from different time zones.

Best and Worst Times to Trade

The most favorable times to trade in the forex market coincide with trading session overlaps, as these times see increased activity and generate news events that can trigger volatility and significant movements.

It’s advisable to use a tool to record the opening and closing times of trading sessions. The “Forex Market Time Zone Converter” can also be helpful in identifying which trading sessions are active in your current local time.

The New York session, in particular, is often the most active and offers intriguing opportunities for traders.

Midweek, it’s common to observe an increase in volatility as the range of movement for major currency pairs tends to expand.

Less Favorable Times

There are times when it’s less convenient to trade in the forex market:

Sundays: On this day, most participants are inactive or enjoying their weekend, reducing liquidity and market activity.

Fridays: During the latter part of the New York session on Fridays, liquidity tends to decrease as many investors are closing positions ahead of the weekend.

Holidays: During holidays, the market tends to be inactive as most traders take a break.

Major News Events: During significant news events, such as significant economic or political announcements, it’s prudent to avoid trading as volatility and risk are higher.

After a Breakup: It’s advisable to take a break after an emotional breakup and avoid trading until you’re in the right mindset.