Pips – A Beginner’s Basic Guide

In this section, we’ll provide you with a basic guide on “Pips” in the Forex market, which is essential for understanding how currency trading works.

- What are Pips?

“Pips” in Forex are an abbreviation of “Percentage in Points” or “Price Interest Point” in English. They are the unit of measurement used to express fluctuations in the value of currencies in a currency pair.

- Value of a Pip:

The value of a Pip varies depending on the lot size (the amount of currency units you are trading) and the specific currency pair. In most cases, a Pip is equal to 0.0001 or one hundredth of a cent.

If you trade a mini-lot (equivalent to 10,000 units of the base currency), the value of a Pip is approximately $1.

Alternatively, if you’re trading a standard lot (100,000 units), one Pip has a value of around $10.

- Interpreting Changes in Pips:

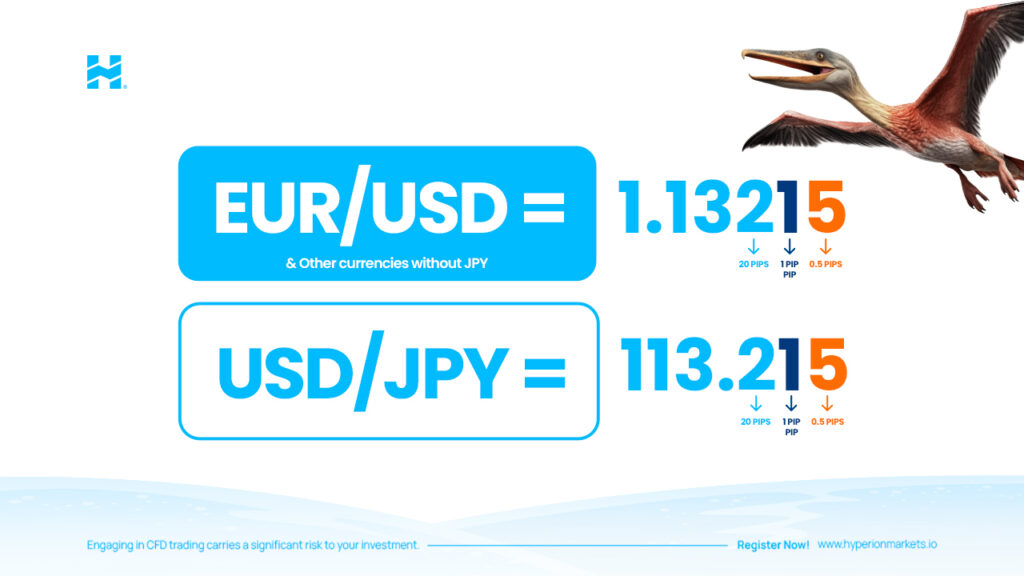

Forex quotes are typically presented with four decimals, such as 1.2345. A change in the fourth decimal represents one Pip.

If the price moves from 1.2345 to 1.2346, it has increased by one Pip.

On the other hand, if the price changes from 1.2345 to 1.2341, it has decreased by four Pips.

- Using Pips:

Pips are essential for measuring profits or losses in your Forex trades.

For example, if you buy a currency pair and the price rises by 10 Pips, you’ve gained a profit of 10 Pips.

If you sell a currency pair and the price drops by 20 Pips, you’ve recorded a profit of 20 Pips.

- Relationship Between Pips and Lot Size:

The monetary value of a Pip is related to the lot size you’re trading. The larger the lot, the greater the value of one Pip.