What is traded in the cryptocurrency market?

In the cryptocurrency market, the main assets traded are the cryptocurrencies themselves. Here are some of the main types of assets that traders commonly trade in the crypto market:

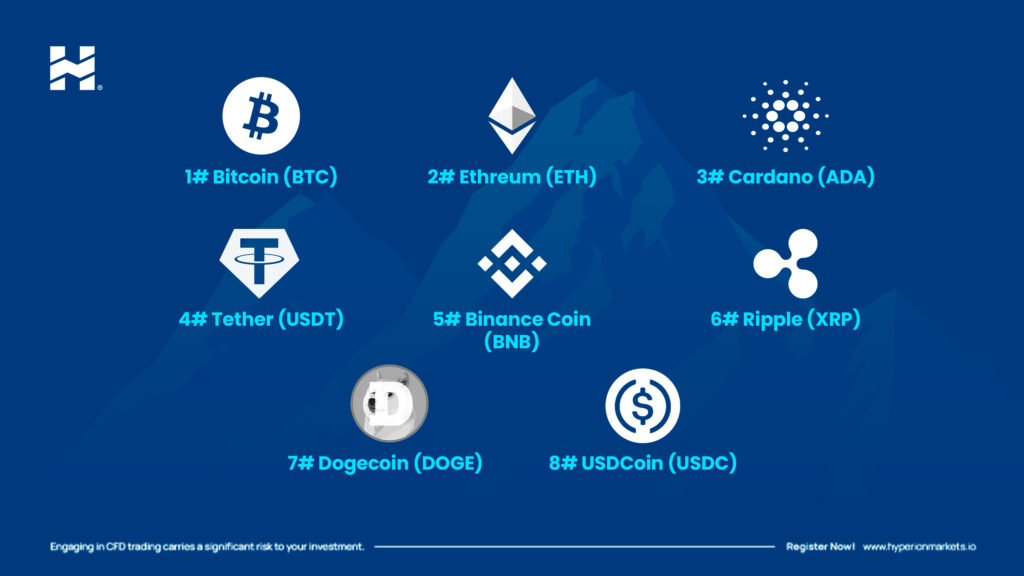

- Bitcoin (BTC): As the first and most well-known cryptocurrency, Bitcoin is a significant asset in the crypto market. Many traders engage in buying and selling Bitcoin to capitalize on price fluctuations.

- Altcoins: This term refers to all cryptocurrencies that are not Bitcoin. Examples include Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and many others. Traders trade altcoins in search of profit opportunities due to variations in their values.

- Tokens: In addition to major cryptocurrencies, there are tokens that represent specific assets or rights within a blockchain platform. These tokens can have various use cases, such as representing ownership of digital assets, voting rights, or access to specific services.

- Stablecoins: These are cryptocurrencies designed to maintain a stable value pegged to a fiat currency like the US dollar. Tether (USDT), USD Coin (USDC), and Dai are common examples. Traders sometimes use stablecoins as a hedge against volatility when they are not actively trading.

- Crypto Derivatives: In addition to directly trading cryptocurrencies, some traders also participate in the crypto derivatives market. This involves trading futures contracts, options, and other financial instruments based on the value of underlying cryptocurrencies.

It is important to note that the cryptocurrency market is known for its volatility, and traders should understand the associated risks before participating in it. Before starting to trade, it is recommended to gain a solid understanding of the basics of trading and the blockchain technology that underpins cryptocurrencies.