Order Types in the Stock Market- Basic Explanation

In the Stock Market, just like in other financial markets, various types of orders can be used to execute transactions. Here are some of the most common types of orders:

- Market Order: A market order is executed immediately at the best available price in the market. This type of order ensures quick execution, but the price at which it is executed may vary due to market volatility.

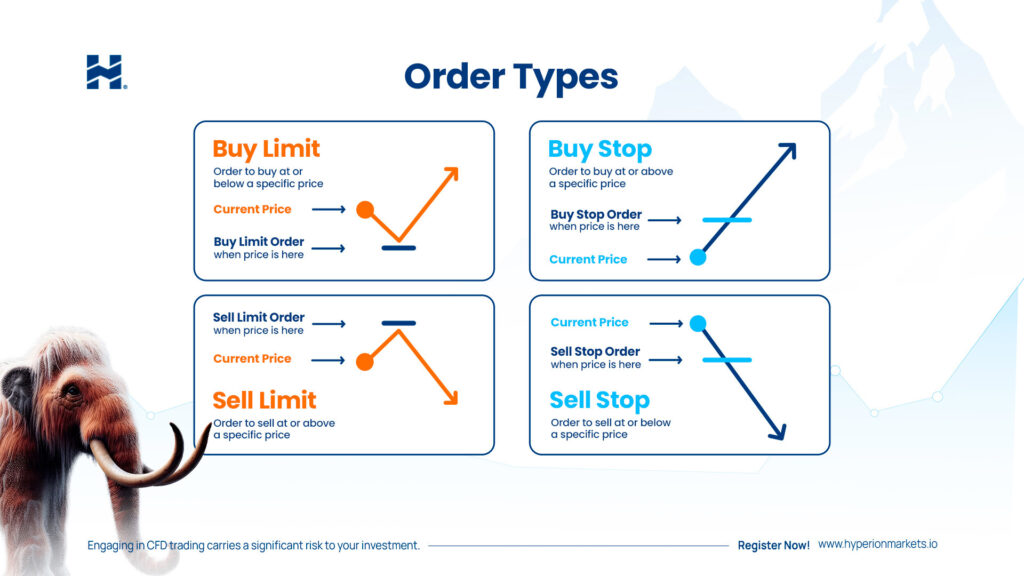

- Limit Order: A limit order allows the trader to specify the price at which they are willing to buy or sell an asset. The order will only be executed at the price you have set or at a better price. It may take longer to execute if the market does not reach the price you have specified. There’s two types of limit orders: Buy limit and sell limit.

- Stop Order: A stop order is triggered when the price of the asset reaches a specific level. It can be a buy stop order to enter a bullish position or a sell stop order to exit a bearish position. There’s also two types of Stop Orders: Buy stop and sell stop.

- Take Profit: It is a predetermined price level at which you decide to automatically close your trade to secure profits.

- Stop Loss: It is a predetermined price level at which you decide to automatically close your trade to limit losses and protect your capital.